(Interest Rates, Charges, Features & Which Bank Is Best for You)

Choosing the right savings account in 2026 is no longer just about opening an account—it is about selecting a bank that matches your income pattern, digital needs, and long-term trust. Among Indian banks, SBI, HDFC Bank, and ICICI Bank are the most compared options because they combine safety with nationwide accessibility.

This detailed comparison will help you understand how these three banks differ in interest rates, charges, digital banking quality, and suitability—so you can make a confident decision without confusion.

Why Compare SBI, HDFC & ICICI Savings Accounts?

These three banks dominate India’s banking ecosystem:

- SBI – India’s largest public sector bank with unmatched reach

- HDFC Bank – Leading private bank known for service quality

- ICICI Bank – Strong digital-first approach with innovation

Many users who already have a 🔗 Zero balance savings account in India later compare these banks to upgrade for better features and long-term reliability.

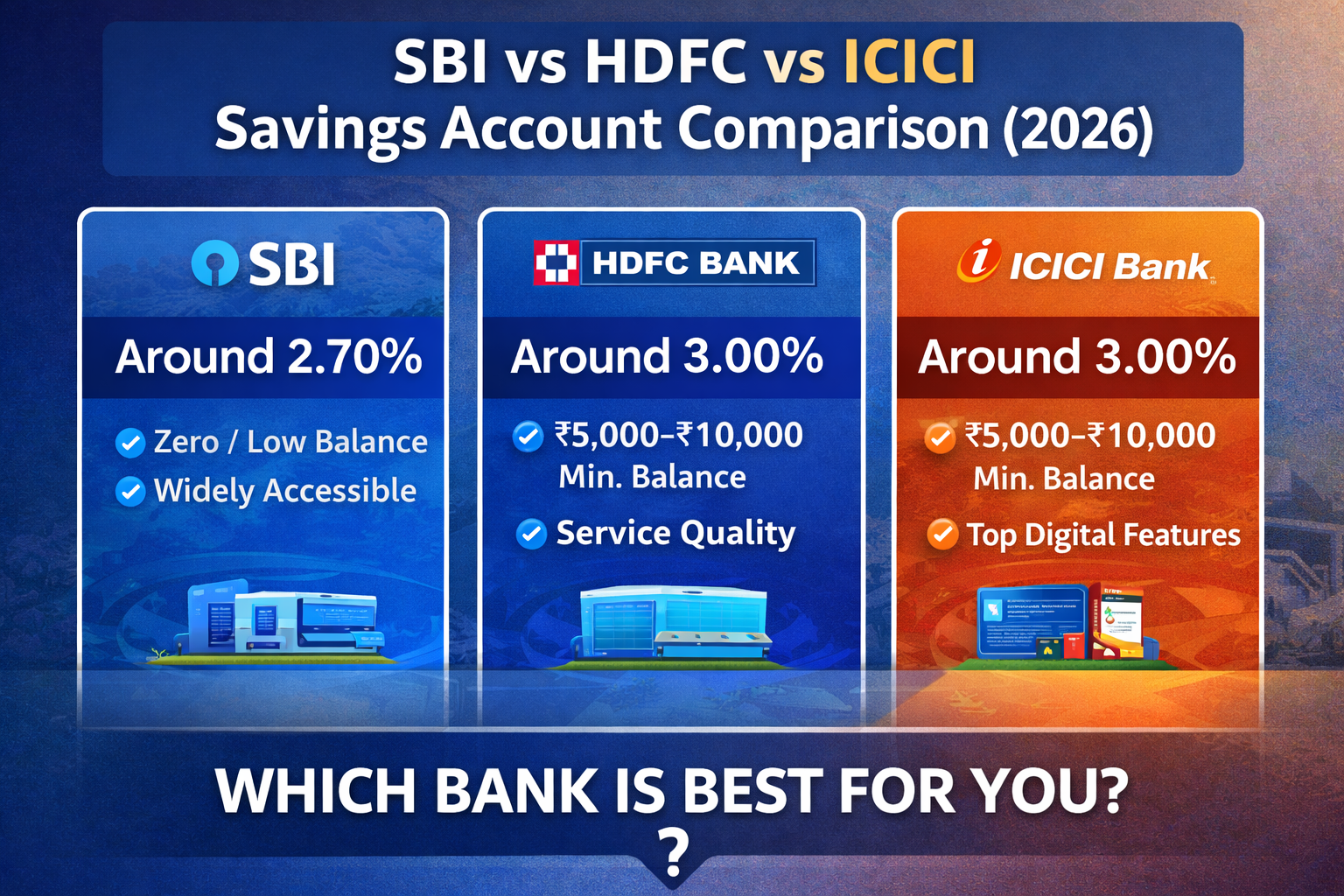

Interest Rates Comparison (2026)

Savings account interest rates are an important factor, but they should be evaluated along with charges and usability.

| Bank | Savings Account Interest Rate* |

|---|---|

| SBI | Around 2.70% |

| HDFC Bank | Around 3.00% |

| ICICI Bank | Around 3.00% |

👉 Rates may vary slightly based on balance slabs and bank policy updates.

If your priority is earning more on idle funds, you may also explore a 🔗 Highest interest savings account in India offered by select banks.

Minimum Balance Requirement

Minimum balance rules can directly impact monthly charges.

| Bank | Minimum Balance |

|---|---|

| SBI | Zero / Low (varies by account type) |

| HDFC Bank | ₹5,000 – ₹10,000 (location-based) |

| ICICI Bank | ₹5,000 – ₹10,000 (location-based) |

SBI is often preferred by users who want fewer penalties, while private banks offer premium features with higher balance requirements.

Charges & Fees Overview

Hidden charges are where many users lose money unknowingly.

| Feature | SBI | HDFC | ICICI |

|---|---|---|---|

| ATM Transactions | Mostly free | Limited free | Limited free |

| Debit Card Charges | Low | Moderate | Moderate |

| SMS / Alerts | Minimal | Charged | Charged |

👉 Always review the schedule of charges before choosing a bank.

Digital Banking Experience

In 2026, digital convenience plays a big role.

- SBI YONO – Improved significantly, good for basic needs

- HDFC Mobile Banking – Stable, user-friendly, fast support

- ICICI iMobile Pay – One of the best apps with advanced features

If app-based banking is your priority, ICICI and HDFC have an edge.

Customer Service & Branch Reach

- SBI has the widest branch and ATM network in India

- HDFC & ICICI offer faster resolution but fewer rural branches

For users in smaller towns, SBI often feels more accessible.

Which Bank Is Best for You?

There is no single “best” bank for everyone.

- Choose SBI if you want safety, low charges, and wide reach

- Choose HDFC Bank if you value service quality and premium banking

- Choose ICICI Bank if you want advanced digital tools and flexibility

Many salaried users compare these banks before deciding, while students usually start with the 🔗 Best savings account for students and later upgrade.

SBI vs HDFC vs ICICI: Quick Verdict Table

| User Type | Best Choice |

|---|---|

| Low balance holders | SBI |

| Salaried professionals | HDFC / ICICI |

| Digital-first users | ICICI |

| Rural / semi-urban users | SBI |

Documents Required to Open an Account

Most banks ask for basic KYC documents:

- Aadhaar Card

- PAN Card

- Mobile number linked with Aadhaar

Keeping all 🔗 Documents required to open bank account in India ready helps complete the process faster.

Online vs Offline Account Opening

- Online: Fast, paperless, ideal for tech-savvy users

- Offline: Better for those who want in-branch assistance

All three banks support both methods.

FAQs

Q1. Which bank is safest among SBI, HDFC, and ICICI?

All three are RBI-regulated and considered safe.

Q2. Which bank offers the best digital banking app?

ICICI and HDFC generally lead in app features.

Q3. Can I switch banks later?

Yes, many users maintain multiple accounts for different needs.

Final Verdict

Comparing SBI vs HDFC vs ICICI savings accounts in 2026 helps you avoid unnecessary charges and select a bank aligned with your lifestyle. Instead of blindly choosing a popular name, match features with your real usage.

A smart comparison today can save money and stress for years.